Part 2: Not All Models Are Created Equally

Defining the DSO Landscape

Our last post focused on what DSOs must accomplish to sustain success over the long term.

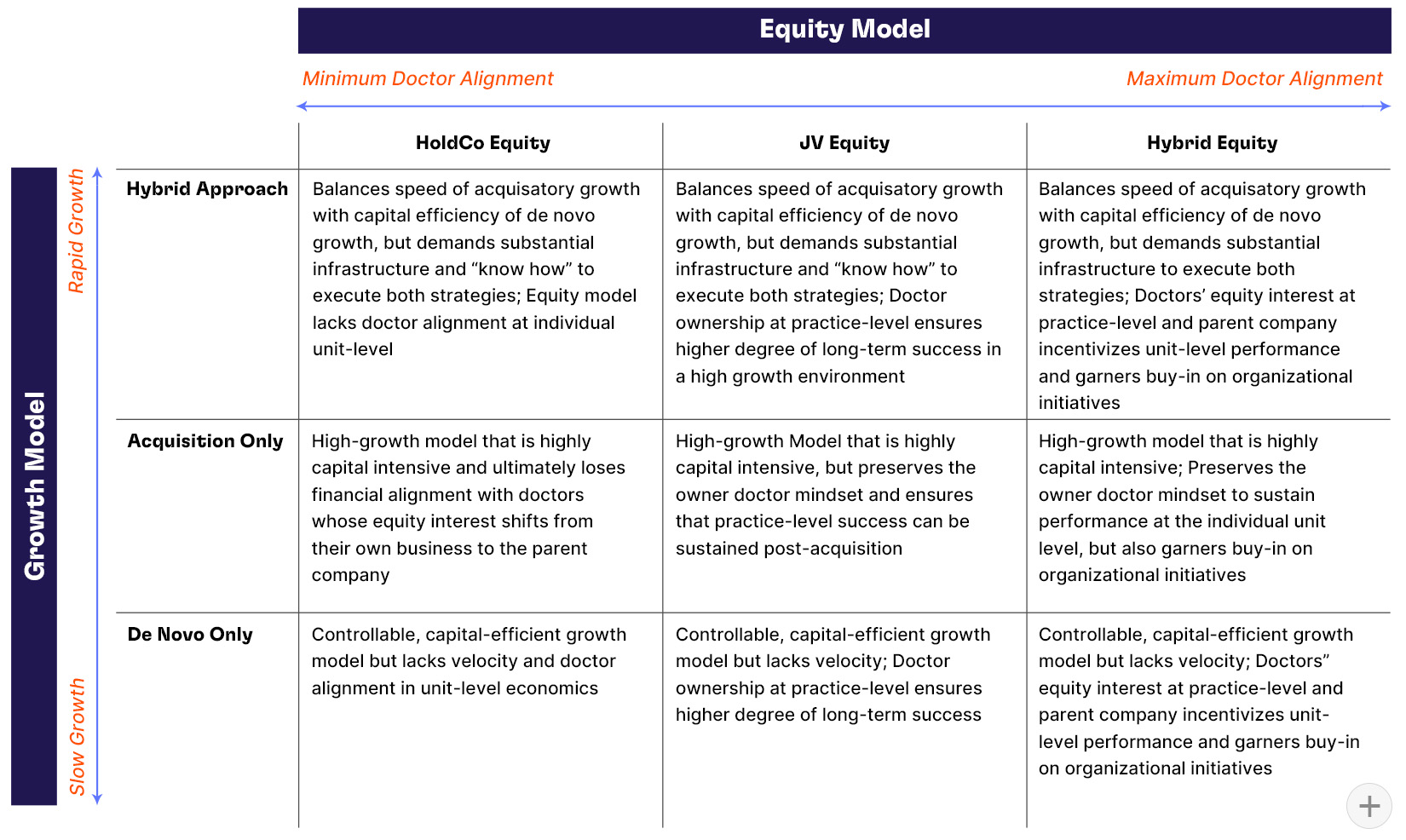

Understanding how different DSO models may effectively deliver on these attributes is core to answering the original question. There are multiple ways to stratify the existing groups, but we define today’s DSO market along two fundamental variables: (1) the growth strategy and (2) the equity model.

Growth Strategies – Build vs. Buy

DSOs have two primary ways to grow: (1) acquire established practices and (2) build scratch starts (“de novos”). Most newly emerging DSOs employ an acquisition strategy due to the speed it brings to a company’s growth. Acquisition models acquire established practices with existing cash flows. This strategy is incredibly capital intensive, and its long-term success is dependent on both the practices continuing to perform as they did prior to acquisition as well as achieving new growth post-acquisition. Any investor will want to see that a DSO executing this strategy is not just buying for the sake of buying but rather thoughtfully acquiring stable practices and improving them over a long-time horizon. If properly executed, acquisition models are excellent at achieving rapid growth, but acquisitions without integration are doomed to fail. Acquisition models that lack a comprehensive integration capability may achieve short-term success but will invariably buckle under the weight of their growth if they cannot consistently bring two different businesses together with minimal disruption. Driving sustainable same-store growth in acquired practices is the greatest long-term challenge of any acquisition-minded platform. Organic growth can only be achieved through the careful selection of practices to acquire and effective integration of core business functions. Valuation pressure is the other challenge that acquisition models face in a competitive market. Since PE-backed DSOs only have access to debt capital up to 5.0x to 5.5x cash flow in this market, their financial returns will be squeezed if they must inject higher levels of equity into their transactions or take calculated risks with their company’s balance sheets to support practice valuations in the 6.0x – 8.0x range. Very few DSOs have sufficient cash flows to maintain a self-funding M&A program (i.e., their free cash flow after servicing the company’s debt and other capital needs can be deployed into new acquisitions).

The other DSO growth strategy is to pursue new scratch starts (“de novos”). This requires a completely different core competency than what’s needed for an acquisition strategy. Building new locations requires the ability to perform market analytics, make site selection decisions, negotiate lease terms, manage a construction process, recruit doctors and staff, and get a fledging operation off the ground. De novo strategies are slower moving than acquisition models due to the lead time needed to construct the practice and then grow it. DSOs willing to pursue this path generally take a longer-term view of their business. The obvious advantage of a de novo strategy is that it is less capital intensive than an acquisition model, and the company has more controls around the practice’s performance from its inception (i.e., physical layout, staffing, marketing strategy, operational procedures, etc.). The primary reason that so few DSOs are willing to employ a de novo strategy is because of the lead time needed to generate meaningful cash flow and the risk that start-up practices may never become profitable without a proven doctor to lead the growth.

Equity Models – Ownership Matters

Early versions of the DSO model from decades ago lacked an equity component for dentists. It was a true “doc in the box” concept. DSOs have since evolved, and now there are varying equity models intended to keep doctors incentivized beyond just their regular income. The prevailing equity model (not just in the dental sector but throughout multi-site healthcare) is known as the “HoldCo” model. Doctors who are a part of this model forgo their practice-level equity and instead become shareholders in the parent company (i.e., holding company). Although generally viewed as being able to get broad alignment with the doctors to work towards a common goal, concentrating everyone’s equity interest in the parent company creates a loss of ownership at the individual unit level. Stated differently, the loss of the individual business owner mindset gives rise to a more collectivist attitude due to everyone’s individual financial outcomes becoming dependent on everyone else’s combined performance. This model has been proven to last over short time durations; however, after the original group of owner doctors retires or leaves, the owner mindset is very difficult (if not impossible) to recreate at the practice level.

The newer equity model that more recently emerged behind MB2 is the joint venture (“JV”) model, which enables doctors to maintain meaningful equity ownership within their practice. This model ensures that both the DSO and the practice owner are financially aligned so that each individual practice maximizes performance. Preserving doctors’ owner mindset ultimately results in better provider retention, higher quality patient care, and more consistent business results. DSOs are held accountable to their doctor partners in this model as they cannot overlook individual practice results in favor of a broad view of their overall portfolio. There are different flavors of the joint venture model that preserve practice-level ownership for the doctors, but not all of them create true alignment with the doctors. This joint venture model only works when both sides of the partnership operate under the same ground rules. Both DSO and doctor partner must get their pro rata share of the practice’s profits and invest their own pro rata share of any capital investment. Upon a DSO recapitalization, both DSO and doctor partner should be able to monetize their ownership interest on the same economic terms within that deal. If a house is only as strong as the bricks that it’s built with, then the joint venture model ensures that each individual brick that makes the house is as strong as possible. There is a core strength that comes with practice-level equity, but DSOs may lack the ability to gain broad buy-in from doctors on company-wide initiatives in a strictly JV-only equity model.

The strongest model to ensure a DSO can sustain itself and its doctors over the coming years is one in which doctors maintain equity ownership within their practices and also have equity ownership in their partner parent company. This hybrid approach has the core strength of a JV-only model and the collective strength of all the doctors who want to achieve the same long-term outcome within their group. Successfully navigating a DSO through the next decade will require a sophisticated infrastructure that can do what a dental practice is unable to accomplish on its own and a group of dental practices that have the entrepreneurial commitment to do what a DSO is unable to do in a top-down manner.

A Third Dimension

These equity models and growth strategies are not new to multi-site healthcare, but how they are executed by DSO platforms has taken on new shapes and directions over the last few years. As continued evidence of the rapid evolution within the DSO space, a new type of platform has emerged with increased velocity over the last three–four years. The creation of specialty-only groups focused on individual specialties, or a combination of specialties, has added a new dimension to the DSO model. The future success of the DSO space must not only contemplate an equity model and a growth strategy but also how DSOs focus their value propositions to the doctors of today and tomorrow.

Our next post will review the considerations of specialty-only vs. multi-specialty groups.